10 Credit Cards That Will Take Your Travel Game Up A Notch

Travelling is becoming one of the basic needs these days.

Everyone around you is travelling, making you want to finally take that vacation you have been planning for such a long time.

It’s time to put your worries behind you and check out some Travel Credit Cards.

These credit cards are a lifesaver and money savers because you can use them for travelling, earn miles points and redeem them to your benefit by saving a huge chunk of money.

Here is a list of travel credit cards that you can use to your benefits:

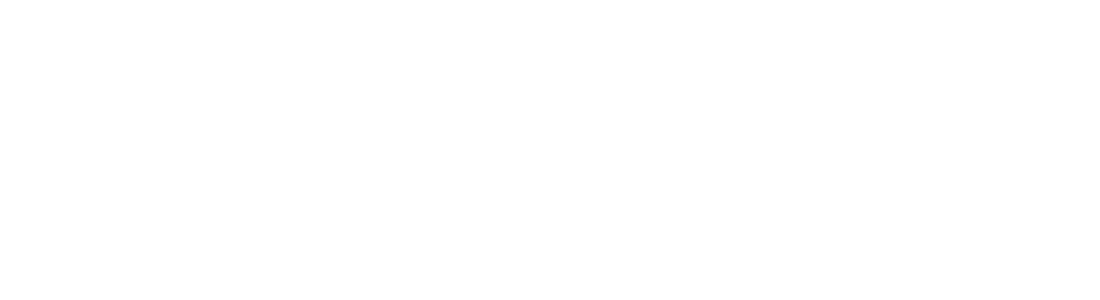

1. HDFC Diners Black Credit Card

For everyone who often flies to various destinations, HDFC Diners Black credit card is a must-have, because it gives unlimited access to airport lounges at no extra cost.

Besides, every time you swipe it for INR 150, you get 5 reward points, meaning you can save 3.3% by using these credit cards.

Annual fees for the first year is INR 10000; however, you will only be paying INR 5000 from the second year onwards. Plus, the welcome gifts and offers you get are almost equal to the annual fees, so you can use all the welcome gifts without any pressure on your wallet.

Eligibility:

- The age should be 21 and 60 for a salaried person with an annual income of 1.75 lakhs per month.

- A self-employed person should be between 21 to 65 with an annual income of more than 21 lakhs per annum.

Benefits:

- INR 2 Crore Air Accident Cover.

- INR 50 Lakhs for medical emergency expenditure.

- INR 9 lakhs for credit card liability.

- INR 55000 for baggage delays.

- Free Lounge access to more than 700 airport lounges in India and worldwide.

- Exclusive discounts at spas, saloons and gyms.

2. Kotak Royale Signature Credit Card

This card is best suited for out-of-the-box travellers who would rather spend their money on travelling. Annual charges are INR 999.

Eligibility:

- Your age should be 21 to 65 years.

- The annual income should be above 24 lakhs per annum.

Benefits:

- You will get four times the bonus points for every INR 150 spent on booking air tickets, hotels, restaurants, and tour operators.

- You are also entitled to complimentary 8 domestic lounge access every year.

- For spending INR 400,000, you will get bonus points of INR 10,000.

- It provides INR 2.5 lakh recovery in case the credit card gets stolen.

Suggested Read: How To Apply For Passport?

3. American Express Platinum Travel

Also known as Amex, American Express Platinum Travel Credit Card is considered the best travel credit card ever. It offers multiple benefits, including free lounge access and several gift vouchers.

Annual charges for the first year are INR 3000 and INR 5000 from the second year.

Benefits:

- Get a premium Taj Hotel gift voucher for INR 10000 once you hit the INR 400000 milestone.

- You earn reward points for every INR 50 spent.

- Provides vouchers for travel companies with zero lost card credibility.

4. Axis Bank Privilege Card

Every traveller prefers this card over others because it has 100% acceptance, besides once you spend INR 2.5 lakhs, you will get INR 7500 value back in the form of reward points or travel vouchers from Yatra. The joining fee is INR 1500.

These vouchers can be redeemed while booking domestic/international flights, hotels, etc.

Eligibility:

- People between the ages of 18 to 70 years are eligible.

- Are able to provide all required documents.

- Active Credit History.

Benefits:

- 12500 reward points can be redeemed.

- 2 Complimentary lounge access.

- For every INR 200 you spend, you earn 10 points as reward.

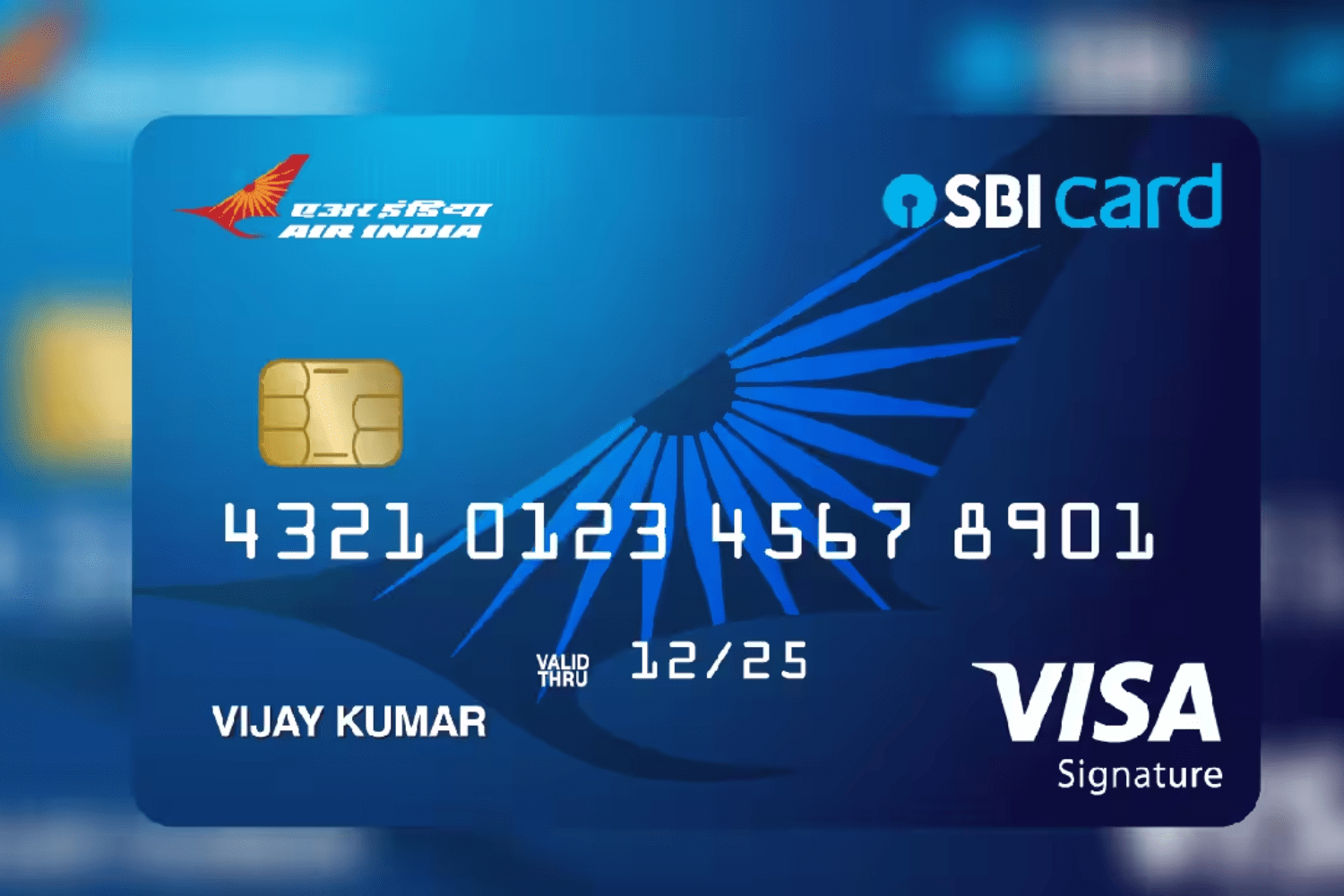

5. SBI Air India Signature Credit Cards

This credit card is especially suited for those who travel via Air India flights. Every INR 200 you spend on Air India tickets will fetch you 30 reward points. You will fetch 30 points for yourself, but if you book the tickets for someone else, you will get 10 reward points.

The annual charge for this credit card is INR 4999.

Eligibility:

- The minimum age requirement for this credit card is 18 years.

- High credit score.

- Must be an Indian citizen.

Benefits:

- Joining rewards is 20,000 points.

- Cumulative reward points are 100,000 if you cross the milestone.

- You will fetch 10 reward points for every INR 100 spent.

Suggested Read: Is Emirates Giving Free Stay In Dubai?

6. SBI IRCTC Credit Cards

This is probably the best credit card for those who travel via train. It gives a 10% discount, besides if you prefer travelling in AC coaches, you are in for many reward points if you have this card.

However, these points can only be redeemed on the IRCTC website. The annual charge is just INR 500, and the renewal fee is INR 300.

Eligibility:

- Must be an Indian citizen.

- Active credit history.

- Should be between 18 to 65 years of age.

Benefits:

- You will get bonus points of 350 as a welcome gift.

- For every INR 125 you spend, you will get 1 reward point(Not applicable for fuel expenses).

- Cashback of INR 100 on the first swipe within 30 days.

7. Yes Preferred Credit Card

This is also one of the must-have credit cards for frequent travellers. The annual and renewal fees are INR 2500.

Eligibility:

- The age should be between 21 to 60 years.

- Net monthly salary should be INR 2 lakhs.

- For self-employed people, ITR should be 24 lakhs or should have a fixed deposit of INR 3 lakh with Yes Bank.

Benefits:

- 20,000 bonus reward points on spending 7.5 lahks in a year.

- 15000 bonus reward points on your first swipe within 90 days.

- You can convert reward points to JP Miles.

- 10000 reward points on each renewal.

- Earn 1000 points on every Yes PayNow registration.

- Fuel surcharge waiver across all gas stations in India with transactions between INR 400 to INR 5000.

8. Citi Premier Miles Credit Cards

The annual charge of Citi Premier Miles Credit Cards is INR 3000. Using this card will fetch you 10 miles points for every 100 INR spent.

Eligibility:

- Your age should be between 21 to 65 years.

- Income criteria will be updated from time to time.

- Resident or non-resident of India.

Benefits:

- On your first swipe worth INR 1000, you fetch 10000 miles.

- For every INR 100 spent, you fetch 4 miles.

- INR 2 lakhs cover in case of a lost credit card.

- Fetch 3000 travel miles during renewal and redeem these points at various websites such as Ibibo, Make My Trip, Yatra, Indigo, etc.

- 15% discount on dining at some selected restaurants.

Suggested Read: Sleep Tourism: A Wellness Trend

9. SBI Elite Credit Cards

SBI Elite Credit Cards is one of the best travel credit cards, allowing 6 international and 8 domestic lounge access in a year. For every INR 100 spent on groceries, departmental stores, dining, and international spends, you fetch 10 points. The annual charge is INR 4999.

Eligibility:

- Your age should be between 18 to 70 years.

- Must be an Indian citizen.

- Credit score should be 750 or above.

Benefits:

- The annual charge and welcome gift are of the same value, so there is no extra cost.

- If you spend INR 10,00,000 in a year, your annual fees will be waived off.

- 10000 and 15000 bonus points on an annual spending of INR 3 lakhs and INR 5 lakhs, respectively.

- For every INR 100 spent on dining, departmental stores, grocery shopping, etc., you fetch 10 points.

- For every INR 100 spent on Vistara bookings, you fetch 9 points.

- Two complimentary movie tickets worth INR 500 every month.

10. Axis Bank Vistara Credit Cards

Those who frequently fly with Vistara Airlines should definitely have this card because the more you spend, you are in for more benefits, including travel miles points which can be redeemed.

Benefits:

- 2% Club Vistara redeemable points for free flights or upgrades.

- Upon reaching the spending milestone, you can get 4 premium economy tickets.

- Discounted golf access, travel insurance, and Club Vistara Silver membership.